-

Direct Payday Loan Lending Resources

Do you know how a payday loan works or what other options exist before considering a payday loan? We know that many people have no idea if a short term loan is right for them or if there are other lending options that would be better. Because of that, we’ve provided a few select links below about the online lending industry. These articles should shed some light on how these types of online loans work. You can also see the problems you may encounter if you borrow money for the wrong reason.

What To Know About Our Direct Lending Offers

Payday loans are unsecured and allow applicants to borrow cash at a high interest rate. If you allow your loan to continue or “rollover” you’ll end up in an endless cycle of short term lending debt. You’ll only pay the interest on your payday loan each payment cycle. No payments are applied to your balance! If we can give you any advice it would be to understand how your online cash advance works before you sign off on it and get your money. While getting cash is refreshing, you’ll run into problems if you don’t understand how your loan works.

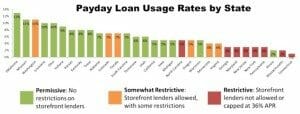

Use these links and resources to find updated information about the direct lender payday loan and installment loan industry. The online loan industry is changing. Each state has different laws and regulations about installment loans and cash advances. It comes to happen that these laws are other in most states. In fact, there are many states with various types of pending legislation. These changes could alter the financing environment for years to come. Be sure you’re on top of your state’s laws regulating online finance lenders. It’s legal in some states for an online company to offer you financing.

Check out the links below if you’re considering working with any online financing companies. There are many cheaper options you’ll want to check out before getting a payday loan from any of the large financial institutions or banks. These choices include a credit card cash advance, a car title loan, or doing odd jobs for money. If you need an online loan as a last option, be sure it’s from a direct payday lender! Remember, you can always find the most recent list of direct payday loan lenders broken down by state and rates offered.

Helpful Resources About Direct Payday Lenders:

Are you still looking for more info about payday loans and how they work? We’re glad you’re being diligent. Here’s a good tidbit for you. Are you talking to a company that offers online payday loans with No Teletrack requirements? This means your options are limited if things go bad. The company may continue taking money from your account without your authorization. The bottom line, is you don’t know what a company will do if they’re not a licensed direct payday lender. Take regulations in California. If you live in California, you have many options for finding a trusted lender. There are hundreds of storefront locations all throughout the state.

You have many online lenders ready to help you with short-term financing. Did you know there are limits in California regarding the fees that a lender can charge you? Lucky for you the interest rates for most online payday loans in CA are capped and it’s now much easier to pay off your loan.

This information is helpful if you’re searching online for direct payday lenders. Use these resources if you come across a company offering an online payday loan with significant interest. It would be best to move on if you find a company with rates and fees higher than most firms. Either this company doesn’t know the laws governing payday loan lenders in California, or they don’t care. Work with firms your respect and be sure to discuss all terms and contract language with your lender.